Planning for your Career

Invest in yourself!

Warren Buffet (Multi-billionaire and Chairman of Berkshire Hathaway Ltd)

‘Where do you see yourself in 5 years?’ is a common questions posed at interviews and certainly worthy of reflection. Wherever you see yourself in five years, remember that it will require planning to get there. Personal growth and self-development can only come about through investing in oneself – learning new value-adding skills and making good financial decisions. The advantage of living in a world of technology is that all the knowledge that we need is readily available at a click and is relatively cheap. There is therefore no excuse not to access information.

In planning for a future career we need to understand that the decision to pursue further studies is a major undertaking and requires careful planning. Hence secondary school learners with their parents or caregivers need to consider the implications of this at least 2/3 years ahead of the time when application is made at the institution of choice. There are a number of sites where one can explore career options. Some institutions provide career advice or one can consult a psychologist to do an aptitude test to determine personality profile and hence career choice. However the vast majority choose careers based on interest, through job shadowing, or what they read about in the media. Career choices should be based on interest or passion, aptitude or ability, as well as market demand for the career and also, affordability to pursue the chosen career.

Once proper research in a prospective field or some kind of job shadowing has been done, it is now necessary to decide at which institution to pursue this and how to access the financial and whatever resources might be needed to make study possible. Fortunately most institutions have websites with detailed information. So, do online research and compile a set of detailed questions which you might want clarified at a face-to-face interview with a relevant staff member. With internet technology and various information resources available there is no excuse not to do thorough research.

One of the most common obstacles to further study is inadequate funding. This includes not only the funds required for study fees and whatever learning materials are required, but also the funds necessary for subsistence – accommodation, food, traveling and clothes.

There are numerous funding sources available in South Africa – ranging from bursaries (often granted on need), scholarships (granted on merit) and loans (accessible through financial institutions and based on good credit history or suretyship). Funding amounts vary from donor to donor, so it is vitally important to do proper investigation. Most institutions have merit scholarships for academically excellent students as well as databases of companies who sponsor bursaries for students. Ensure to visit these institutions soon and acquire the most up to date copy. Also read your local newspapers and network in your local church, with family and friends. Where possible, speak to people who work in large corporations and who could investigate bursary opportunities there. Some of these might have conditions attached which include repayment periods or employment obligations, so remember the adage, ‘Nothing for mahala’; there’s no thing as a free lunch!

Doing proper research, developing a comprehensive yet concise curriculum vitae, applying early and complying with application criteria are what puts an applicant in a favourable position. However there are also other criteria that apply such as the need for specialist skills. With legislated Corporate Social Investment (CSI) policy most South African companies invest in education, albeit in scarce skills (skills which are nationally considered to be in short supply often the ones in technology and accounting). However this does not mean that there isn’t funding for other courses, it merely means that applicants to the non-scarce skills study options need to be more creative, proactive and determined in their applications. Remember, no-one wants a mediocre student, so be the best you can be and try to impress the potential sponsor!

Choice of career, financial resources and institutional reputation will determine the choice of institution. This places the onus on the applicant to investigate the admission criteria and other requirements.

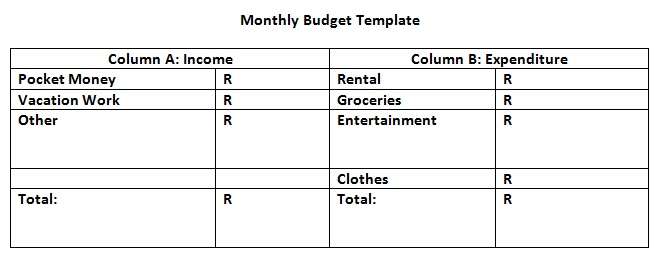

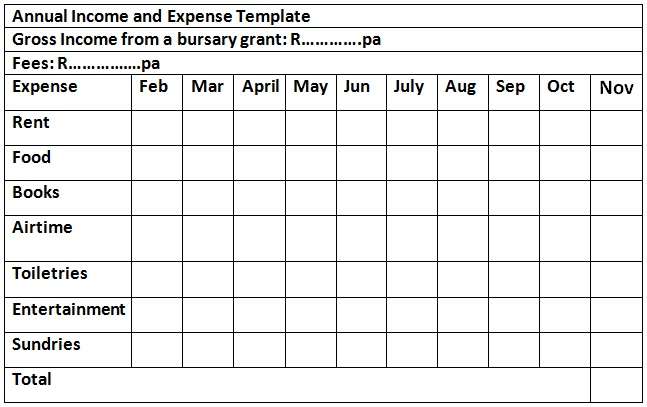

Now that you’ve agreed on a career and choice of institution, you are ready to devise your financial plan. The financial planning process should follow a set of clearly identified and considered steps that build on each other. At the outset you need to identify your current financial situation, where you are right now and where you aspire to be in order to achieve your goals. Once you have a clear picture of your income at hand from either a bursary, scholarship or finances from parents, you should be able to budget its spend for the duration of the year. The Income and Expenditure template below should assist you to do this. What should be of key importance is whether you end up with a net surplus, that is, available money, or a net deficit, where you’ve exceeded your income.

If by chance you arrive at the end of the year with a net surplus, a common mistake made by many students is to attempt to spend all their money in anticipation of the bursary disbursement for the following year. However, since most companies that offer bursaries only tend to make payments at the end of the first quarter of the following year (April), it is wise to keep some money in reserve to tide you over for your registration fees and whatever expenses might be incurred at the beginning of the year.

Activity

Below is a Monthly Budget template as well as an Income and Expenditure template for you to practice on. The latter is designed to accommodate a 10 month average academic year. Incorporate the figures that apply to your life. This will give you a reasonably accurate picture whether you’ll end up with a net surplus at the end of the year after your expenses, or with a net deficit.