Savings

Do you want to save money for something special? Or do you want to invest your money for the future? How do you work out what is the best way to save money? Are there different ways to save money? Can you have more than one savings account at the same time?

All the banks and financial institutions offer slightly different things, so it requires some research to find out what will work best for you.

Themba and Lerato have finally decided to open an account to save a deposit for a car. They’d like to be able to save money over a few months because they want to buy the car quite soon. What savings account will give them the best return on their money?

The first thing they need to understand is the difference in types of savings accounts (often given different names by different banks!). Here are some of them.

The basic savings account

You can deposit and withdraw money whenever you want to. This is a good way to start saving money, especially for something you want to save for in the short term. Different banks offer different options but you can earn up to about 4.75% annually (per year) on whatever you have deposited into it.

Fixed term deposits (7 days or 32 days are common)

A fixed term deposit requires you to put a certain amount of money away for a fixed period of time, i.e. a 7-day notice account means you can only withdraw your money seven days after you have given the bank formal notice that you want to do so.

Some fixed deposit accounts allow you to put money in monthly but others want you to put one lump sum of money in at the beginning of the time period (and you can’t add to it during the specified time).

A 7-day notice or even a 32-day notice account provides you with both a higher interest rate than a normal savings account and because you have to wait the notice period before getting your money it forces you to think carefully before withdrawing. This encourages you to keep saving!

A one-month fixed deposit is also an option as you can just then roll it over at the end of every month if you do not need the money.

Some banks don’t offer 7-day Fixed-term Deposit Accounts and others require a minimum amount be deposited into the account. Interest rates also vary between banks and their different deposit options.

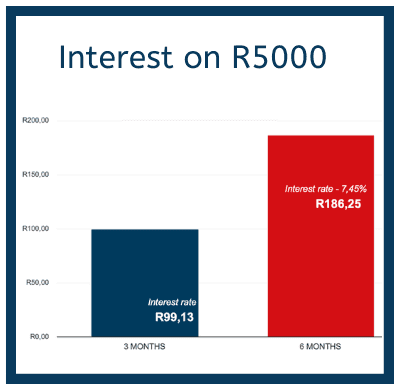

If Themba and Lerato put R5,000 into a 3-month fixed-term account at an interest rate of 7.45%, they will earn R93,70 interest at the end of the term. If they invested their money for six months, they would earn even more interest.

Money market accounts

Money market or money maximiser accounts are useful for lump sum investments. They offer flexible savings with much higher interest rates than a normal savings account. The downside is that the minimum amount of money required to keep the account open can be fairly high.

Each bank differs with their minimum deposit amount. Interest rates are frequently relatively high and the more money you invest, the higher your interest rate is, so the more money you make.

Compound interest happens when you don’t draw any money from your account and the interest you earn adds to your original sum of money. You then earn interest on your interest!

Before Themba and Lerato can make their decision about saving for their car deposit they need to do a lot of research to find out what works for them. The 32-day Fixed-deposit Account looks like it may be something worth exploring further. They can open this and keep their normal bank account open at the same time. In fact, it’s possible to have a number of different accounts open at once.

If you want to save towards the deposit of a car, a good short-term goal would be to get rid of any credit card and hire purchase debt. Even cutting out smoking, if you happen to be a smoker, can considerably increase the money you have to save. Once you have established what your disposable income is and set up your savings account, you will be on your way to saving for your car (or any other large item.).

Remember that you can go into a branch of your bank (or any bank that you might be interested in) and ask a consultant to explain the different savings accounts to you. All the different accounts and their interest rates are also available for you to research on the internet.

Once Themba and Lerato have saved a deposit for a car, they will need to approach a specialised motor financing house or bank to apply for a loan for the rest of the cost of the car.

The bigger your deposit is for the item you want to purchase, the less you’ll have to borrow to make up the purchase price. The fact that you can put down a deposit increases your chances of being approved for finance. Usually, a 10% deposit would be a minimum to aim for, but anything more than this will save you lots of interest. Also remember that the longer your repayment term, the more interest you will end up paying to the finance house or bank.

So, the solution is to borrow as little as possible, and to borrow for as short a period as possible.

Although it requires some sacrifice in day-to day spending, saving money for something you really want can be satisfying. Not only will you reduce the interest you have to pay on the loan but you can also make interest on the money you save. A win-win situation!