Purchases and contracts

Are you tempted to spend all your money when you first receive it? Have you opened accounts and signed contracts to buy items that you haven’t yet earned the money to buy? It’s so tempting, isn’t it? And, let’s be honest, for those really big items it may well be a good idea to buy them over a period of time. Who can afford to pay cash for a car?

But, before you go out and buy whatever you want, you’ll need to budget your money carefully. This means thinking about what you’ll need to save up for, and what might be a necessary hire purchase item. A hire purchase item is something you buy and pay off in monthly instalments, to which interest is added.

Themba receives his first pay cheque and what does he do? He opens contracts and accounts and buys all sorts of things! Is Lerato right to be angry with him? Let’s find out.

When you buy things on hire purchase, for example, or when buying clothes on account, you are actually paying quite a bit more for them than if you paid cash. Let’s say Themba decides to buy a leather jacket over a 16-month term. What would he actually pay for the jacket versus its cash price?

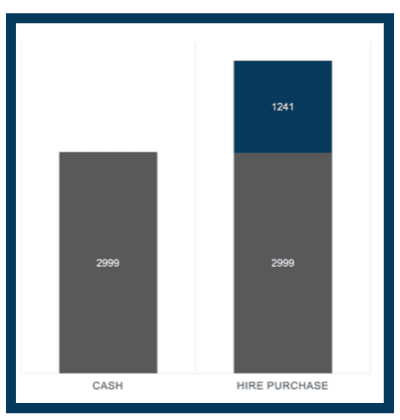

The following is an example taken directly from a retailer’s online site in which the cash price is R2,999; however, the hire purchase price is R265 but one needs to pay this every month for 16 months. This means that in the end you pay R4,240 for the leather jacket (see the graphic below).

This means that Themba will pay at least R1,241 more for the jacket than if he pays cash for it! (And, he may pay even more, for hire purchase service and insurance fees.) This is nearly 50% more than the cash price. If Themba saves his money and pays cash for the jacket, he will save himself R1,241.

It seems that Lerato does know about the dangers of hire purchase! With the extra R1,241 that Themba would save by paying cash for the jacket, he could start saving for the deposit towards a car.

Themba has taken out two fixed-term contracts: one for his phone and one for a gym membership. Once you’ve signed fixed-term contracts, you will need to pay the monthly instalment for the contract term or pay a cancellation fee. Think very carefully before you sign these contracts!

About fixed-term contracts:

• Phone contracts usually last a minimum of 2 years.

• Gym contracts are between 12 or 24 months.

• You have to pay the monthly fees whether you attend the gym or not. You have to pay for the phone, even if you drop it or it is lost or stolen (unless you pay for insurance at an additional cost).

• If you decide to cancel your contract before the end of the contract term, you will be charged a cancellation fee based on how much you still owe them for the full term.

• This cancellation fee is supposed to be ‘reasonable’ but often it is expensive.

• Fixed-term contracts roll on over from your contract period automatically. In other words, it doesn’t end after the 2 years or whatever the contract time period is, unless you cancel it.

• The service provider is obliged to contact you and let you know what your options are, towards the end of your contract period. But they will continue to charge you on a month-by-month basis unless you let them know that you want to end it.

Some advice:

• Always check the cancellation clause and see how much you will have to pay if you do need to cancel.

• Don’t sign anything until you are sure about all the Terms and Conditions.

• Always take the shortest period possible for a gym contract if you really decide you want one. You never know whether you will move, or change jobs, and you will no longer be able to go to the gym.

• Don’t be tempted to take a longer term contract for a gym just because it seems a good deal. Gyms rely on people paying for membership, who then don’t go. This means that they get money for nothing!

So how do you afford to buy items that you definitely need to buy, as well as those that you want to buy, if you can afford them?

The first thing to do is to draw up a budget and stick to it. A budget is a financial plan to show how much money a person earns (income) and how much they have to spend (expenses) in a certain time frame.

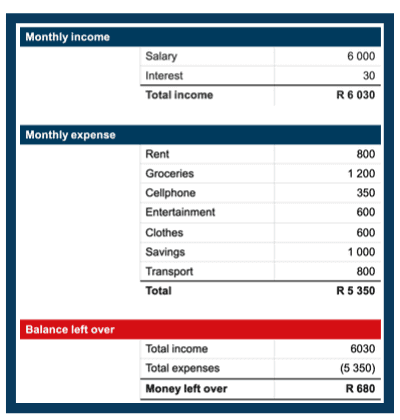

Themba should work on a clear monthly budget, like this one. It helps him see what he can afford to buy, once he has paid his expenses and put money into savings for longer term purchases (such as a deposit for a car).

Here is an example of Themba’s budget:

By creating a monthly financial plan, Themba can see what he has to pay and how much money he has left over. He’s included savings here as Lerato wants him to save for the deposit on a car. By drawing up this budget he will realise that he does not have money to waste on things that aren’t necessary. If Themba does save, he will soon be earning additional income by earning interest through the bank.

So how do you increase your money? By saving or investing money!

If Themba saves R1,000 per month in a standard savings account, he will start to earn interest on that money. Depending on the institution he chooses to save with, he could earn about 5% per year on the money he invests. He could deposit his money into a fixed term savings account. In this type of savings account, you put money into savings for anything from 6 months to 2 years or longer. The more you save and the more you invest, the more interest you will earn. You could earn over 7% or more on the money you’re saving.

In other words, if Themba puts R1,000 into a fixed deposit savings account over 12 months he could get back about R360 from the bank for doing nothing but saving! By the end of the year, he will have saved R12,360. This is a decent chunk of money to go towards a car deposit.

So, it seems that Lerato does understand why it’s important that Themba saves his money, rather than spending money he doesn’t have on items that are not necessary, such as a gym membership. It’s much cheaper to buy as many items as possible, including clothes, using cash, rather than paying much more for something, just to have it now!