Long-term planning for the future

Has something unexpected ever happened to you or your family, so that you’ve needed extra money to cover the expenses? Or, do you want to own a car but don’t have the money to buy one? How do you go about planning your money so that you don’t find yourself drowning in financial debt? Or not being able to achieve what you most need or want in life?

Like many things in life, it’s important to plan for unexpected events and save for items that you really need. Or, perhaps you really want to have something but it’s not absolutely necessary. You’ll need to know if, or when, you can purchase it.

Having a long-term financial plan means that you have a strategy of saving or investing your money for longer than one year. When you plan ahead like this it means that you are less vulnerable to unexpected events. You can feel more secure about your future financial situation, and your ability to face the unknown.

Baba’s investment in a funeral policy was a worthwhile effort at long-term financial planning. The benefits of a funeral policy are:

• You pay a small sum, for example R30 per month, and you will be covered for a specified amount (e.g. R100,000) towards funeral costs.

• You can take a funeral plan for yourself and a number of your dependents. The number of beneficiaries for the policy is limited by the insurance company. Some allow up to 21 beneficiaries, but this is also limited by what you can afford to pay.

• Each company works out what you can afford to include in your contract, based on the money you have available to invest. This means that each policy is personally worked out for your circumstances.

• Applying for a policy is free. You are entitled to ask for as much information as you need before you sign the contract. The company offering you the policy is obliged to explain the terms of the policy to you, in a way that you understand, before you sign it.

Be very careful, though! Here are some things to look out before you sign anything:

• Always make sure you read the fine (small) print at the bottom of the document before you sign any contract or policy. Sometimes things are excluded in the contract and you won’t know about this until you have read everything in the document!

• Insist that the insurer or person who has drawn up the contract explains everything to you, in a way you understand, before you sign anything.

• Make sure that all the fields in the document are complete. Do not sign any ‘blank’ or incomplete forms.

• If you pay by debit order, make sure about the start date and on which day the money will be taken from your account.

• Know exactly what you are paying for, and make sure you always pay your policy on time. Some companies will give you a couple of months’ waiver (when you don’t pay for your policy) but only if you let them know why you can’t pay them. If you don’t pay the premiums in your policy regularly, your policy will lapse. You will not get any of the benefits, unless you pay the outstanding premiums.

Perhaps Baba did not read the entire contract, including the fine print which specifically excluded the tombstone as a benefit. Or perhaps he did not realise that he needed to add it as a special benefit. You can prevent this happening to you by understanding all the details in the policy. This means that you won’t have any nasty surprises when you make a claim!

Financial institutions and investment companies provide opportunities for long- and short-term planning. Short-term financial planning is about making financial decisions which affect what you are able to save or spend within the short term, i.e. within a year or less. For example, you know that you will need to travel home in a few months’ time for a holiday. This means that you will need money for transport and gifts for your family. So, short-term financial planning would be to do with saving now, so that you have the money for your holiday when you need it.

Long-term financial planning is about making money decisions that will have longer term impacts on your life, in many areas. This could be buying a car or house, or saving for tertiary education.

For Baba long-term planning was taking out a funeral policy. This is an important safeguard against unexpected debt. However, because his policy did not provide for a tombstone, he needs short-term financing to cover the cost of this. When faced with this crisis, Baba makes a poor short-term financial decision. Instead of looking at all of his options – including the type and cost of the tombstone, or negotiating terms with the supplier – he goes to a loan shark. If he had considered alternatives, he may have found a way to meet his needs yet not get into debt or be charged high interest.

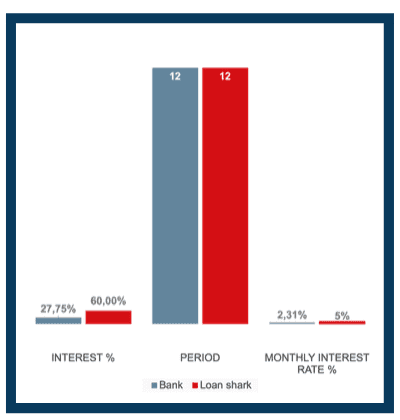

Loan sharks are not called ‘sharks’ for nothing. It might seem quick and easy to borrow from them in an emergency but the price you pay for your debt is huge. Loan sharks charge massive interest rates. Because they operate outside of the law there is no control over the amount of interest they charge you. No bank, according to the National Credit Act, may charge anyone more than 27.75%. This means that loan sharks are charging you much more than the banks.

Here follow two infographics showing you how much Baba will pay for a R7,000 tombstone by borrowing money in different ways. The calculations are both based on Baba having to pay back the money, and the interest, over the period of a year. They are calculated using a compound interest rate formula. The loan shark charges 60% interest, compared to a bank, which calculates the loan at the maximum legal interest rate of 27.75%.

As shown in the charts below, if Baba had taken the loan from the bank, and had had to pay it back over a year, his monthly repayments would have been R675 per month and he would have paid R1,092 in interest to the bank.

However, if he’d taken the loan from a loan shark, he would have needed to pay monthly repayments of R790, and the total interest would have been R2,473.

This means that over the course of the year Baba has to pay an additional R1,381 to cover the higher interest rate.

Loan sharks also often use intimidation and shame to get their money back, if you don’t pay them on time.

Long-term planning enables you to work towards opportunities that you hope to achieve in the future, be it funding for tertiary education or selling products to your customers in the following season. Sadly, the possibility of anyone winning the first prize in the Lotto is one in 20,358,520 – so it’s not a useful way of planning your financial future! Do you think Bra Mike knows this?

Avoid putting yourself into unnecessary debt by buying things that you don’t absolutely need, like fashion items and cellphones. You will end up paying much more for them because of the interest you will be charged. Rather save your money until you have the cash to buy these short-term items.

Think carefully about your financial goals for the future and plan for unexpected events. If you put a long-term financial plan together, you will be more likely to succeed in achieving these goals and overcoming any financial hardships that may unexpectedly come your way.