Making a business budget

What is a business budget?

For your business plan in the last chapter, you worked out the basic sums of income and expenditure. But you will need to think more about this and work out a proper budget.

A business budget is a detailed outline of how money will work in a business, day to day. How much will Nolwazi need to buy her first chickens? How much capital or money does she already have? Making a business budget lets you see how much money you need, and what resources you already have.

Making a budget helps to avoid running out of cash. For example, Nolwazi needs to make the best use of the small loan she will get from Ma Ruby. In her budget she can include both short-term goals and long-term goals.

Short-term goals for starting up her chicken business might be: budgeting to buy her first chicks, and materials to make chicken coops, as well as renting a space to keep them. This type of goal helps immediately in the present.

Medium-term goals might include: money for marketing expenses once the business is up and running. She could buy a small advert in the community newspaper, to advertise and help sell her chickens and eggs.

Long-term goals are ways of expanding or growing the business once it’s operating. Maybe Nolwazi will rent a bigger piece of land, so she can have more space for more chickens. Nolwazi could also advertise on social media platforms like Facebook or Instagram, in search of new customers who will buy her chickens. Long-term goals help the overall growth of businesses over time.

The aim of the budget is to make a business successful, and to keep it going.

How to make a small-business budget

There are some simple steps Nolwazi could take to draw up a budget for her own business, either digitally or on paper.

Step 1. Analyse costs

Before you start, research the cash costs involved in your business. If you need more money than you have, you will not be able to achieve your goals. Your revenue and profit should increase as your expenses grow. Revenue is the money made from a sale per chicken and profit is income less expenses.

Your budget should include these costs:

- Fixed costs such as rent, mortgages, salaries, internet, accounting services, and insurance. (If Nolwazi gets some chickens, she willl need to rent land, for example.)

- Variable/changing costs such as cost of goods sold and labour. (Nolwazi will have to buy chickens, but there are seasonal demands. At Christmas, everyone wants a roast chicken to celebrate!)

- One-time costs such as building repairs or a security fence. (Nolwazi might consider a security camera, to stop chicken thieves.)

- Unexpected costs such as theft and disease. (Nolwazi’s chickens might get sick, and then she wouldn’t be able to sell them. She would have to pay for a vet to visit her little business.)

Step 2. Negotiate costs with suppliers

Before you set your budget, you will have a talk to your suppliers and try getting discounted rates for the materials, products, or services. Nolwazi is lucky because Sive grows vegetables, so she helps with food for the chickens in exchange for eggs. Nolwazi needs to look for the most efficient ways to reduce her costs.

Negotiation will also build up a relationship of trust with all kinds of the suppliers. They know Nolwazi will pay them reliably — in full and on time.

Step 3. Estimate your revenue (how much money will come in)

You need to work out how much you are going to charge for your product or service — and also try to work out realistically how many chickens you will need to sell, etc, so you can work out how much money will come into your business on a monthly basis.

It’s a good idea to track income and expenses regularly so you can see the patterns and understand what’s going on. Keep careful records of money coming in and going out (cash flow). You must know how much you are spending, and how much you are making too! You can do this in lots of ways: if you’re just starting out, you could write it down in a book or a proper book-keeping ledger, or you could type it up on an Excel spreadsheet. You could also find an app to download that will help you to organise your finances.

Never mix your personal money with your business income! Some people use separate bank cards or accounts, so they know what business expenses are, and also how much cash they have to buy new stock.

You need to make sure your revenue covers your expenses — and more — to ensure a viable business!

Which brings us to step 4…

Step 4. Know your profit margins

Profit is the amount of money your business has after expenses. Gross profit is the cash you are left with after your business has paid all the costs for making or producing your product. Other business expenses aren’t included.

Net profit is what your business makes after subtracting all your costs. This includes things like rental and insurance and bills.

So Nolwazi would list all the expenses that she had to pay for her business, and subtract those from her overall sales revenue to work out her profit.

Remember that a business should increase profit and reduce costs.

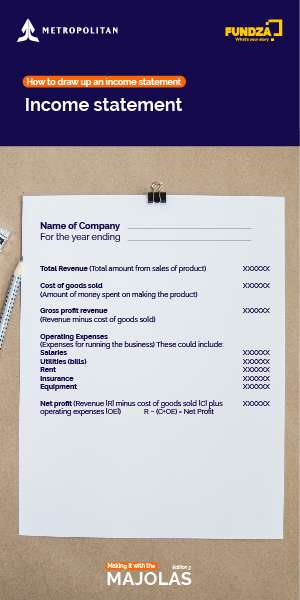

Here is an example of a template for working out gross and net profit.

Step 5. Project cash flow

Cash flow is customer payments (from buyers to you) and vendor payments (from you to your suppliers). They should balance, so that there is cash flowing in your business.

Nolwazi might have problems with customers who buy chickens ‘on tick’ (credit) but who find that they cannot pay at the end of the month. It’s important for businesses to have common payment channels — usually cash, credit card and so on. But some customers will miss payments, and this will affect your cash flow negatively.

Nolwazi might encourage payment by giving customers a few more days or another month, but must also make strict policies for paying late — maybe adding interest. Unfortunately, there are usually a few customers who never pay, and you will need to have some money in your budget to cover that ‘bad debt’.

Step 6. Factor in seasonal and industry trends

Dezemba is a good month for chicken farmers: everyone has been paid, and wants to celebrate by spending. But Janu-worry always comes, and money is scarce again. Nolwazi knows that there are a few months where sales are slow, and she will have to pay school fees or help out her family members with their needs too. This is called seasonal inconsistency. She will have to make sure there is enough money in the budget from the peak times to tide her over in the low times.

Step 7. Set spending goals

Nolwazi might want fancy new fans to keep the chicken coops cooler in the hottest months, but these are not necessities. She has to spend her money wisely so that her business stays viable: maybe she can find some second-hand fans online, or trade some chickens for them. If she has spare cash, Nolwazi could invest in those expenses that would benefit her business in the long run — such as marketing or advertising, like sponsoring an event or competition.

Step 8. Bring it all together

Have you followed the first seven steps? If so, it’s time to create your budget.

Remember:

- Income minus fixed and variable expenses will give you the amount of money you can work with.

- There will be unexpected one-time expenses! Be prepared.

- Know your short-term and long-term goals, and use your money to achieve them.

There are lots of free budgeting applications available online but it helps to understand how the steps work.

Resources beyond the budget: Skills, experience, community resources, etc

Business is not only about managing money. So much of starting a successful business is about thinking creatively and sharing resources.

Think of who is available in your community. Are there retired people or students looking for experience who could help your business for free? As soon as Busi and Sive see that Nolwazi is struggling, they help her clean, and the work goes quickly. Nolwazi has made use of her social network (her friends’ skills and experiences in cleaning and organising) to lighten her load. They are one of the community resources she already has around her.

But they can’t help her every night! They also have their own jobs, families, studies and social lives to sort out. Families and friends often help one another in business, but there must be a fair exchange.

When you are thinking about your own business, try to work out what makes sense for you to do yourself (because it needs your special skills), and what you can pay an employee to do (because it saves you time that you can spend doing other business activities).

Here are some reminders about technical and business terms in this section.

Glossary

budget: amount of money you need or have for a purpose

cash flow: total amount of money coming into and going out of a business

credit: getting goods or services before payment, based on the trust that payment will be made in the future

debt: money that is owed or due (bad debt is money that is never paid, and the business absorbs that loss)

expenses: money you spend to achieve a task or prepare your services or products for sale

fixed costs: known payments you expect to make every week, month or year — rent, loans, salaries, internet, accounting services, insurance, and so on

gross profit and net profit: gross profit is all sales income minus the direct costs of getting the product or service ready to sell; net profit is the sales income minus all the business costs

income: money that comes to you — payment for your services or product

ledger: a book or digital collection of accounts that is a record of all the financial transactions (money in or out of the business)

profit: money left after expenses, costs and taxes

revenue: the total amount of income from the sale of goods or services, while income is earnings or profit — revenue minus costs and operating expenses

seasonal inconsistency: changing or irregular sales according to what customers need: some times of the year are busy, and others are not

stock: equipment, materials, or supplies to sell

shrinkage: when equipment, materials, or supplies are damaged or stolen, so you can’t sell them

suppliers/vendors: the people who farm, grow or make the things you sell. You buy your products from them to sell to your customers.

variable costs: payments you have to make, but they change. Costs of goods sold, labour, and so on.