It’s your first time working and suddenly you’re earning a bit of money. How do you make sure it doesn’t run out before the week or month is over? How do you decide what’s important to spend money on, and what’s not?

This is called budgeting. Most of us – myself included – have seldom drawn up a monthly budget. But, that’s OK, we can always start somewhere. The sooner you take control of your money, the faster you’ll make sure that your money does stretch to the end of the month!

Here’s how to create a budget.

You’ll need:

• A notebook or laptop/phone

• A pen (if using a book)

• Your salary payslip or the amount that you’ll be earning

Okay, now that we’ve got our materials sorted, let’s look at the steps needed to budget.

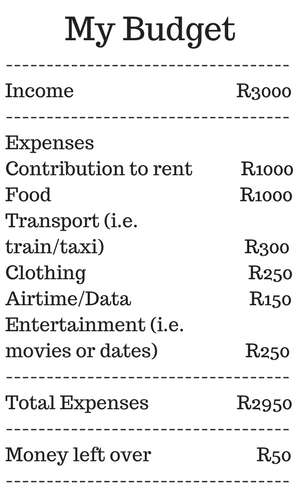

Step 1: Write down your income. If you earn different amounts each time you work, then write down the average of what you think you’ll be earning. When estimating your income, it is better to estimate a lower amount than you may earn… that way you are less likely to get a nasty surprise at the end of the month. In our example, we’ll work with a monthly income of R3000.

Step 2: Make a list of all the important things that you’ll need to spend money on, for example: rent, transport and let’s not forget, food!

Step 3: Once that’s done add the other important things on your list such as clothing, airtime and entertainment.

Step 4: Now that you’ve got your list on paper, write down the amount you expect to spend on each of them.

Everything you spend money on is called expenses and the money you earn is called income.

What to include in your budget:

Rental: If you are paying rent this should be the first thing in your budget.

Transport: Unless you’re lucky enough to be able to walk or cycle to work, you have to pay for transport. So, make sure you set enough money aside for it. Think about your different transport options and what would help you to make the most of your budget.

Food: Everyone needs to eat, make sure you plan for this so that you can have enough food and maybe a snack or two! It is so tempting to spend money on Mcdonalds or KFC when we get paid, but be wise and think about the weeks ahead.

Airtime: You want to always be connected with your friends therefore, you need airtime, anyone at work might need to get hold of you, make sure you got moola on that phone.

Clothing: You may need to look professional for work so prioritise your spending here carefully. Remember, however, that it’s better to look after the clothing that you have well so that it lasts a long time and doesn’t have to be replaced too often.

Entertainment: This is probably the least important item on your list, but everyone needs to have a social life, so do put some money aside for this. Have fun, but don’t go too overboard.

Here’s an example of what your list will look like:

Your budget will depend on what is essential for you, what you prioritise and the amount of income you have. The above example shows that the person is left with some money, because their expenses are less than their income.

Your goal should be to have money left over each month. That way you can save a little bit of money for emergencies or you can save up for something special down the line.

Remember when you spend more than you earn you can find yourself broke at the end of the month. Not a good feeling!

TIP: Keep track of where your money goes, by collecting your till slips. This will make it so much easier to see where your money is going and where you should spend less money on.

Remember that every cent counts – if you know where it goes you can be sure it won’t run out.

Tell us: Has this blog helped you in any way?